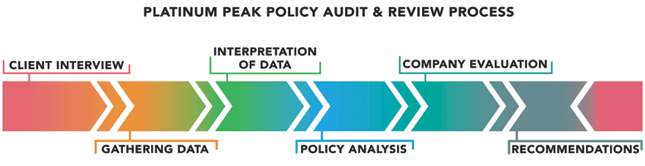

Making the Most of Your Insurance Portfolio

The Life Insurance Policy Audit and Review process integrates the client’s need for a brief education in the complex world of life insurance, with their need to understand their specific policy’s existing and future benefits, costs and options. The following process helps to identify the current need, value and appropriateness of your existing life insurance policies.

Step 1: Client Interview

The process begins with the client interview. Through this process, we are able to ascertain the client’s concerns and goals, and whether the insured’s original intentions and life insurance needs are still being served by the existing policies and whether changes are needed. The interview will encompass the both subjective and objective information on the client’s current financial situation and prospects for the future.

Step 2: Data Gathering

To properly evaluate a life insurance policy, we require very specific policy information that is not always easily obtainable from the insurance company. As always, the quality of results depends on the quantity and quality of the data obtained. Our life insurance audit and review process includes obtaining the original policy and as sold illustrations, recent annual and quarterly statements and current in-force projections, along with the detailed accounting pages.

Step 3: Interpretation of Data

Upon receipt of the data, it is verified for accuracy through a specific review process. Once the data is determined to be accurate, the interpretation process is implemented. The interpretation of data process is where the policy specific data is evaluated and converted into our standard format. This format prepares the data for our next step, which includes an overall policy evaluation, performance and policy tax analysis.

Step 4: Policy Analysis

This step involves an intensive study and evaluation of all policy data. The analysis includes an evaluation and comparison of prior and future premiums, cash values, expenses, cost basis, taxable gain and other financial related data. We will then identify policy longevity options with varying premium amounts and compare to the current policies in the market. We will also identify returns, using IRR as a measure of financial value.

Step 5: Company Evaluation

Not all insurance companies are of equal strength. Accordingly, the insurance company evaluation step is critical to the audit and review process. We evaluate an insurance company’s financial stability, its ability to pay future claims, its investment portfolio and yields as well as its overall rating as compared to all life insurance companies. This step draws company specific data from the leading independent rating agencies in the world including A.M. Best, Moody’s, Standard & Poor’s and Fitch, as well as other available data and analyses.

Step 6: Recommendations

In this final step, we provide clients with our recommendations regarding their existing insurance policies. Clients will receive a written summary of their policies with recommended modifications for implementation. It will be presented in a simplified one to two page format with addenda, so that the suggestions and policy recommendations are easily understood and implemented.