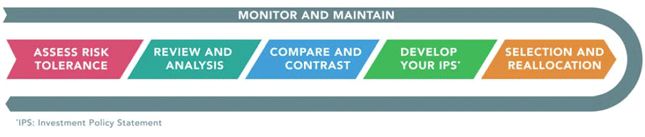

Process Steps

1. Assess Risk Tolerance

This first step involves a comprehensive discussion about risk and reward with a sophisticated risk tolerance assessment tool. It is through this process that we will develop an understanding of the client’s goals and philosophy so we may develop a comprehensive investment strategy and a recommended asset allocation.

2. Review and Analysis

With the client’s assistance, we will gather, review and analyze his or her current investments including statements, portfolios, holdings and return on investment (ROI) reports. This allows us to see where the client is now, how their investments are performing, whether they have appropriate diversification and if their investments are aligned with their goal and philosophies.

3. Compare and Contrast

We will compare a client’s current portfolio allocation to their appropriate allocation considering their risk tolerance and investor profile identified in step 1 above. We will identify those portfolio areas in which the client is overweight and underweight and discuss an approach that will more appropriately reflect the client’s investment goals.

4. Develop Your Investment Policy Statement (IPS)

An IPS is a written statement that helps to clearly communicate to all relevant parties the procedures, investment philosophies and guidelines of a client’s investment program. The IPS document ensures the long-term adherence to a set of guidelines that the client and the financial advisor both agree on.

5. Selection and Reallocation

With access to a wide array of investment opportunities, Platinum Peak will provide one or more options for the client’s consideration that reflect the client’s goals and philosophy as stated in the Investment Policy Statement. We often utilize highly qualified investment managers who create tailored portfolios for our clients. After discussion of the options presented, the client will select their choice of investments and investment models.

6. Monitor and Maintain

Platinum Peak’s involvement is dynamic and continuing, as markets cycle and a client’s concerns and objectives can evolve. It is therefore critical that investments are monitored consistently and reviewed periodically. Portfolio adjustments may be indicated for life changing events including:

- Varying income needs over time

- Semi‐retirement and full retirement

- College expenses

- Death of a spouse

- Support for children